Introduction

The stock market is a dynamic and often complex system that attracts millions of investors looking to grow their wealth. Whether you are a beginner just starting out or an intermediate investor with some experience, understanding the stock market today is crucial for making informed decisions.

The stock market today is influenced by a range of factors, from global economic conditions to individual company performance. In this guide, we will break down the key components of the stock market and help you navigate through its intricacies.

We’ll cover everything from the basics of stock trading to the more advanced aspects that affect the market’s behavior today. By the end of this article, you’ll have a clearer understanding of how the stock market operates and how you can make more informed investment choices.

What is the Stock Market?

At its core, the stock market is a platform where buyers and sellers trade shares of publicly listed companies. When you purchase a stock, you’re buying a small ownership stake in a company, and as the company grows and becomes more profitable, the value of your investment can rise.

The stock market operates on the principle of supply and demand. If more people want to buy a particular stock (high demand), its price will increase. Conversely, if more people are looking to sell (high supply), the price tends to decrease. The stock market is made up of various exchanges like the New York Stock Exchange (NYSE), Nasdaq, and others that facilitate this trading.

Why is the Stock Market Important?

The stock market is a key component of the economy for several reasons:

- Capital Raising: Companies use the stock market to raise capital for expansion, innovation, and new projects. When a company goes public, it can raise funds from investors, which are then used for business development.

- Investment Opportunities: It provides individuals with opportunities to invest in businesses they believe will grow and become more valuable. This opens the door to wealth creation for investors.

- Economic Indicator: The performance of the stock market often reflects the health of the economy. A rising market generally indicates a strong economy, while a declining market might signal economic troubles.

- Job Creation: As companies expand due to capital raised through stock offerings, jobs are created, and the overall economy benefits.

Detailed Step-by-Step Guide

Step 1: Understand the Stock Market’s Structure

Before diving into trading, it’s important to understand how the market is structured. It’s not just about buying and selling stocks—it’s about understanding the exchanges, brokers, and market indices.

- Exchanges: These are platforms where stocks are bought and sold. Major exchanges include the NYSE, Nasdaq, and London Stock Exchange.

- Brokers: Brokers act as intermediaries between you and the stock exchange. They charge commissions or fees for executing trades on your behalf. Online brokers like Robinhood, E*TRADE, and TD Ameritrade have made stock trading more accessible to retail investors.

- Indices: Market indices such as the S&P 500, Dow Jones, and Nasdaq Composite are used to measure the performance of a group of stocks, which can provide insights into the market’s general direction.

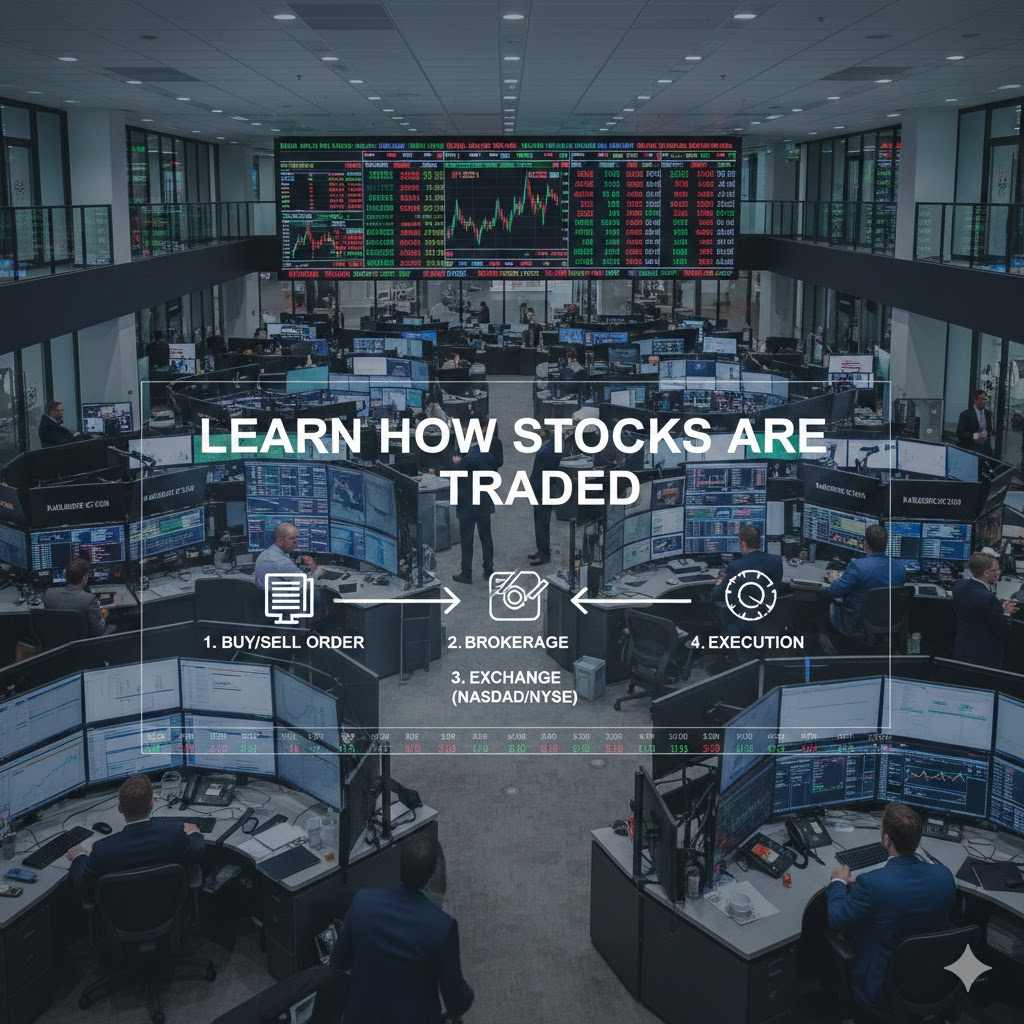

Step 2: Learn How Stocks Are Traded

Trading stocks is relatively simple, but it requires a good understanding of the following:

- Market Orders: A market order buys or sells a stock immediately at the current market price.

- Limit Orders: A limit order buys or sells a stock only at a specified price or better. It provides more control over the transaction price but might not get executed if the stock doesn’t reach the target price.

- Stop Orders: A stop order becomes a market order once the stock hits a specific price point. This is often used to limit potential losses.

Step 3: Monitor Market Movements

Stock prices don’t remain static. They are constantly changing based on a variety of factors, such as:

- Company News: Earnings reports, management changes, product launches, or any significant news about the company can move stock prices.

- Economic Data: Government reports on employment, inflation, GDP growth, and other economic indicators can impact the stock market.

- Global Events: Geopolitical events, pandemics, or other global crises can influence market sentiment and stock prices.

By keeping track of the market’s movements, you can make better investment decisions and react to changes quickly.

Step 4: Risk Management

One of the most critical aspects of investing in the stock market is risk management. Here are a few ways to protect your investments:

- Diversification: Don’t put all your money into one stock. Spread your investments across different industries and sectors to reduce risk.

- Set Stop-Loss Orders: A stop-loss order automatically sells a stock if its price falls below a specified level, preventing further losses.

- Research: Always research the companies you invest in. Understand their business model, financial health, and growth potential.

Benefits of Investing in the Stock Market

Investing in the stock market has several potential benefits:

- Wealth Growth: Historically, the stock market has provided substantial returns over the long term, making it an effective wealth-building tool.

- Liquidity: Stocks are liquid assets, meaning you can easily buy or sell them whenever the market is open.

- Dividends: Some stocks pay dividends, which can provide regular income in addition to potential capital gains.

- Ownership: By purchasing stocks, you become a partial owner of the company and can benefit from its success.

- Tax Advantages: In some cases, long-term capital gains are taxed at a lower rate than short-term capital gains, making it more tax-efficient for long-term investors.

Disadvantages / Risks of the Stock Market

While the stock market offers many benefits, it also comes with its share of risks:

- Market Volatility: The stock market can be volatile, with prices rising and falling rapidly. This can lead to short-term losses if you’re not prepared.

- Investment Losses: There is always a risk of losing money, especially if the companies you invest in perform poorly or if the market as a whole goes through a downturn.

- Emotional Investing: Investors who react emotionally to market movements may make impulsive decisions that can lead to losses. It’s important to stay calm and stick to your investment strategy.

- Lack of Control: As a shareholder, you have limited control over the company’s operations or performance. External factors such as management decisions or economic events can impact your investment.

Common Mistakes to Avoid

When investing in the stock market, avoid these common mistakes:

- Chasing Quick Gains: Trying to make quick profits can lead to poor decision-making and losses. Focus on long-term growth.

- Not Doing Enough Research: Never invest in a company without doing thorough research. Understand its financials, competitors, and the broader market conditions.

- Failing to Diversify: Don’t put all your eggs in one basket. Diversify your portfolio to reduce risk.

- Ignoring Risk Management: Always have an exit strategy and use tools like stop-loss orders to manage your risk effectively.

FAQs

Q1: How can I start investing in the stock market?

Start by opening a brokerage account with an online platform, then deposit funds, and begin researching stocks that align with your investment goals.

Q2: What is the best time to invest in the stock market?

There’s no one-size-fits-all answer, but a long-term investment approach works best for most people. Avoid trying to time the market.

Q3: What are blue-chip stocks?

Blue-chip stocks are shares in well-established, financially stable companies with a history of reliable performance.

Q4: Can I lose all my money in the stock market?

Yes, there is always a risk of losing money in the stock market. However, with proper research, diversification, and risk management, you can minimize potential losses.

Q5: Should I invest in stocks or mutual funds?

It depends on your investment goals. Stocks offer higher growth potential but come with more risk. Mutual funds offer diversification but generally provide lower returns.

Q6: How can I protect my investments during a market downturn?

Diversifying your portfolio, using stop-loss orders, and staying calm during market fluctuations can help protect your investments during downturns.

Expert Tips & Bonus Points

- Stay Informed: Keep up with market news, economic reports, and financial trends. The more information you have, the better your decisions will be.

- Think Long-Term: Don’t get caught up in short-term market fluctuations. Focus on long-term goals and investment growth.

- Use Tax-Advantaged Accounts: Consider using tax-advantaged accounts like IRAs or 401(k)s for long-term investments to reduce your tax burden.

- Reinvest Dividends: If you invest in dividend-paying stocks, reinvest those dividends to maximize your returns over time.

Conclusion

The stock market today offers many opportunities for wealth growth, but it also comes with risks. Understanding the market, doing your research, and managing risk are essential for becoming a successful investor. Whether you’re just starting or looking to improve your strategy, the key to long-term success lies in staying informed, being patient, and sticking to your investment plan.

By following the steps outlined in this guide, you can build a solid foundation for your investment journey and increase your chances of success in the stock market today.