Introduction

The global market is constantly evolving, influenced by numerous factors like technological advancements, geopolitical tensions, economic policies, and consumer behavior. Keeping track of global market updates is crucial for anyone involved in business, finance, or investment. These updates provide insights into current market trends, upcoming challenges, and emerging opportunities.

In this article, we will dive deep into the importance of staying updated on the global market, the steps to understand market shifts, its benefits and risks, common mistakes to avoid, expert tips, and more. Whether you’re a business owner, investor, or just someone curious about the global market, this guide will help you navigate through the complexities and keep you informed.

What is the Global Market?

The global market refers to the interconnected marketplace where goods, services, capital, and labor are exchanged across borders. It’s driven by global trade agreements, supply chains, financial markets, and international investments. The concept of a global market encompasses not just the exchange of goods but also the movement of ideas, innovations, and capital that transcend national boundaries.

Today, global markets are shaped by factors like international policies, trade tariffs, currency fluctuations, global demand for goods, and technological disruptions. Events like financial crises, pandemics, or major political shifts can drastically affect the dynamics of the global market, making it vital for businesses and individuals to stay informed.

Why is the Global Market Important?

Understanding the global market is crucial for a variety of reasons:

- Informed Decision-Making: Keeping up with market updates helps businesses and investors make informed decisions about investments, expansions, and risk management.

- Predicting Market Trends: By analyzing updates, you can anticipate market movements, helping you to stay ahead of competitors and seize emerging opportunities.

- Global Economy: The global market influences the broader economy. Changes in one region can ripple across the world, affecting industries, currency values, and commodity prices.

- Investment Opportunities: A well-informed perspective on the global market opens up opportunities for diversification, whether in stocks, bonds, or international business ventures.

- Risk Management: Understanding market shifts allows businesses and investors to mitigate risks, such as inflation, recession, or currency devaluation.

Detailed Step-by-Step Guide to Understanding Global Market Updates

1. Stay Updated with Reliable Sources

The first step to understanding global market trends is to regularly consult trustworthy and reliable sources. This includes:

- Financial news websites

- Economic reports

- Industry blogs and market analysis platforms

- Government websites for policy updates

By using reliable sources, you can avoid misinformation and ensure your decisions are based on factual, up-to-date data.

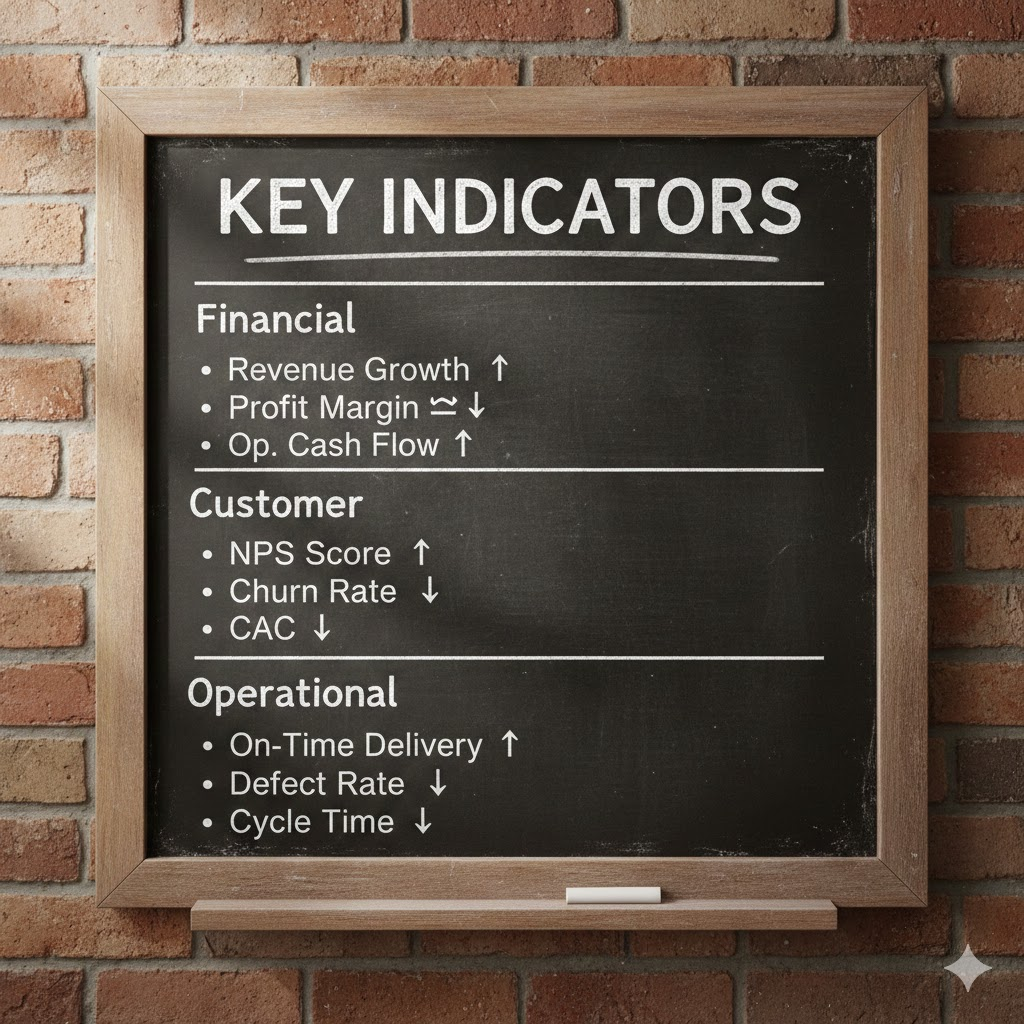

2. Understand the Key Indicators

To interpret market updates effectively, you need to understand key economic and financial indicators that influence the market:

- GDP Growth Rates: A country’s Gross Domestic Product (GDP) growth rate is one of the most important indicators of its economic health.

- Inflation Rates: Rising inflation can lead to reduced purchasing power and increased costs for businesses and consumers.

- Unemployment Rates: High unemployment can indicate economic instability, affecting consumer spending and overall market demand.

- Interest Rates: Changes in interest rates, especially from central banks, can have a significant impact on investment decisions and market behavior.

- Commodity Prices: Commodities like oil, gold, and agricultural products play a crucial role in global trade and can affect the economy significantly.

3. Monitor Market Sentiment

Market sentiment, often shaped by news, political events, and social movements, can greatly impact the global market. Monitoring sentiment involves:

- Tracking stock market indices (S&P 500, FTSE 100, etc.)

- Analyzing commodity price movements (oil, gold, etc.)

- Watching for shifts in consumer confidence and sentiment

Understanding market sentiment can help you gauge the future direction of the global market, allowing you to adjust your strategies accordingly.

4. Keep an Eye on Major Global Events

Major global events can have a profound impact on the market. Some examples include:

- Natural Disasters: Hurricanes, earthquakes, or floods can disrupt supply chains and affect market stability.

- Geopolitical Events: Trade wars, political instability, or military conflicts can influence markets, especially in regions directly impacted by the event.

- Technological Advancements: Innovations like AI, blockchain, and renewable energy technologies can disrupt industries and create new investment opportunities.

Staying informed about these events can give you the insight needed to predict short-term and long-term market shifts.

5. Analyze Regional Markets

While it’s essential to keep a global perspective, it’s also important to focus on regional markets. Some regions may experience rapid growth due to local economic policies, while others may face challenges due to political instability. For instance:

- Asia: Countries like China and India are emerging as global economic powerhouses, with rapid technological advancements and growing middle classes.

- Europe: The European Union and its economic dynamics, such as Brexit, can influence global markets.

- The U.S.: As one of the largest economies in the world, U.S. market trends and policies (such as Federal Reserve decisions) have a far-reaching impact on global trade and investment.

By analyzing both global and regional markets, you can make more nuanced and informed decisions.

Benefits of Keeping Up with Global Market Updates

- Better Investment Decisions: Keeping updated helps you identify potential opportunities, such as emerging markets or industries poised for growth.

- Risk Mitigation: Understanding economic and political changes can help you reduce exposure to market risks like inflation, recession, or currency volatility.

- Increased Competitiveness: By tracking market trends, you can adjust your business strategy to stay competitive in a rapidly changing environment.

- Improved Planning: Market updates enable you to plan for long-term growth and sustainability, whether you’re an investor or business owner.

- Global Insight: A global market perspective gives you a better understanding of the interconnectedness of economies, allowing you to make more informed choices.

Disadvantages / Risks of Global Market Updates

- Uncertainty: Global market trends can be unpredictable, making it difficult to accurately forecast future developments.

- Information Overload: With so many updates and sources available, it can become overwhelming to sift through all the information to find the most relevant insights.

- Short-Term Volatility: Frequent market updates can highlight short-term fluctuations that may not accurately reflect long-term trends.

- Biases in Reporting: Not all market updates are neutral or unbiased, so it’s important to verify the credibility of sources to avoid misinformation.

Common Mistakes to Avoid

- Ignoring Regional Differences: A global perspective is essential, but focusing only on large economies without understanding regional nuances can lead to missed opportunities.

- Overreacting to Short-Term Market Moves: Often, market updates highlight immediate reactions, but it’s important to look at the long-term picture rather than reacting impulsively.

- Following Trends Without Research: Many investors and businesses chase trends without thoroughly researching the market, which can lead to losses.

- Neglecting to Diversify: A single region or industry might experience a downturn. Diversification is key to managing global market risks.

- Relying on One Source: Relying on one news source for updates can lead to biased information. Always cross-reference multiple reputable sources.

FAQs

1. How can global market updates affect my business?

Global market updates impact your business by providing insights into economic conditions, consumer behavior, and industry-specific trends that may affect demand, supply, and your operational costs.

2. Where can I find reliable global market updates?

Some trustworthy sources include reputable financial news outlets, government publications, global financial institutions, and industry-specific reports.

3. What is the impact of geopolitical events on the global market?

Geopolitical events can lead to volatility, influencing currency values, stock markets, and supply chains. For instance, trade wars or political instability in key regions can disrupt global business activities.

4. How do interest rates influence the global market?

Interest rates determine the cost of borrowing, influencing consumer spending, investment activities, and inflation rates. Changes in interest rates can either stimulate or slow down economic growth, affecting global markets.

5. Can global market updates help in predicting economic recessions?

While it’s difficult to predict recessions with certainty, global market updates provide indicators like GDP growth, unemployment rates, and consumer sentiment that can help predict economic downturns.

6. How do technological innovations impact the global market?

Technological innovations can disrupt existing industries, create new markets, and drive economic growth. For instance, advancements in artificial intelligence, renewable energy, and e-commerce are reshaping industries worldwide.

Expert Tips & Bonus Points

- Use Data Analytics: Leverage data analytics tools to track market trends and make more informed predictions.

- Diversify Investment: Avoid putting all your resources into one market or industry. Diversification reduces risk and increases potential returns.

- Follow Central Bank Policies: Central banks, especially the Federal Reserve, play a critical role in shaping global markets through monetary policies like interest rate changes.

- Be Patient: Global market trends take time to unfold. Instead of reacting to short-term volatility, focus on long-term opportunities.

- Monitor Emerging Markets: Countries and regions experiencing rapid economic growth, like Southeast Asia and Africa, offer significant investment potential.

Conclusion

Staying updated on global market trends is not just for investors or business owners; it’s essential for anyone who wants to understand the forces shaping the world economy. By keeping up with reliable updates, understanding key indicators, and analyzing regional markets, you can make informed decisions that position you for success.

Whether you’re managing a business, investing in global assets, or simply trying to understand the world around you, tracking global market updates is key to thriving in an interconnected and rapidly changing world.